For any business owner, managing cash flow is fundamental to staying afloat. Two key components of this financial juggling act are accounts payable (AP) and accounts receivable (AR). Understanding the difference between them and managing them effectively can be the deciding factor between a business that thrives and one that struggles.

Understanding Accounts Payable (AP)

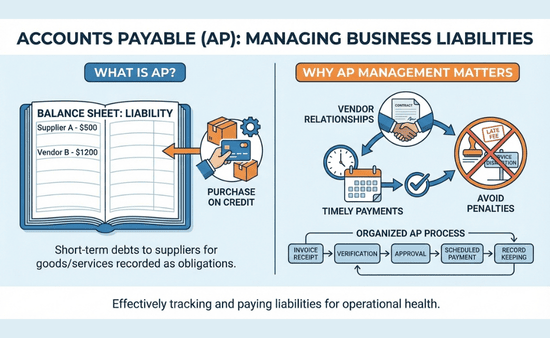

Accounts payable, often abbreviated as AP, refers to the short-term debts your business owes to its suppliers and creditors. When you purchase goods or services on credit, the amount you owe is recorded in your AP ledger. This is a liability on your company’s balance sheet, as it represents an obligation to pay cash in the near future.

Effectively managing your AP is crucial for maintaining good relationships with your vendors. Paying bills on time prevents late fees, service disruptions, and damage to your business’s reputation. A well-organized AP process ensures that all liabilities are tracked accurately and paid promptly.

Common Accounts Payable Processes

The AP cycle involves several steps, from receiving an invoice to making the final payment. A typical workflow includes:

- Receiving the Invoice: The process begins when you receive a bill from a vendor for goods or services rendered.

- Invoice Verification: Before payment, the invoice must be carefully checked. This involves matching it with the corresponding purchase order and receiving report to confirm that the goods were received as ordered and the pricing is correct. This is known as the three-way match.

- Approval: Once verified, the invoice needs to be approved for payment by the appropriate manager or department head.

- Payment Processing: After approval, the finance team schedules the payment. This could be via check, ACH transfer, wire transfer, or credit card, depending on the agreed-upon terms.

- Recording the Transaction: The payment is recorded in the general ledger, which reduces the accounts payable balance and the cash account.

Best Practices for Managing AP

Efficient AP management can save your business money and strengthen supplier relationships. Here are some best practices to follow:

- Centralize AP Processes: Have a single, streamlined system for receiving and processing invoices. This reduces the risk of lost invoices and duplicate payments.

- Negotiate Favorable Payment Terms: Work with your suppliers to establish payment terms that align with your cash flow cycle. You might be able to negotiate longer payment periods or secure discounts for early payments.

- Automate Where Possible: AP automation software can handle tasks like data entry, invoice matching, and payment scheduling. This not only saves time but also reduces the likelihood of human error.

- Maintain Clear Communication: Keep an open line of communication with your vendors. If you anticipate a delay in payment, inform them as soon as possible to maintain a good working relationship.

Understanding Accounts Receivable (AR)

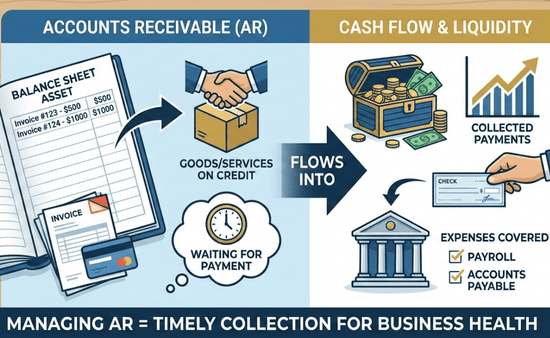

Accounts receivable (AR) is the opposite of accounts payable. It represents the money that customers owe your business for goods or services they have purchased on credit. When you issue an invoice to a customer, the amount due is recorded as an asset on your balance sheet because it’s expected to be converted into cash.

Managing AR effectively is vital for your company’s cash flow. A well-run AR process ensures that you collect payments from customers in a timely manner, providing the necessary liquidity to cover your own expenses, like payroll and accounts payable.

Common Accounts Receivable Processes

The AR cycle focuses on ensuring customers pay what they owe on time. The process typically looks like this:

- Creating and Sending Invoices: After delivering a product or service, you generate a detailed invoice and send it to the customer. The invoice should clearly state the amount due, payment terms, and due date.

- Tracking Payments: Monitor incoming payments and update customer accounts accordingly. This helps you keep track of who has paid and who has an outstanding balance.

- Following Up on Overdue Invoices: If a customer doesn’t pay by the due date, the collections process begins. This usually starts with friendly reminders via email or phone calls.

- Resolving Disputes: Sometimes, customers may dispute charges on an invoice. Your AR team needs to investigate these issues promptly and work with the customer to find a resolution.

- Recording Payments: Once payment is received, it’s recorded in your accounting system, which increases your cash balance and decreases your accounts receivable balance.

Best Practices for Managing AR

A proactive approach to AR can significantly improve your cash flow and reduce bad debt. Consider these best practices:

- Establish a Clear Credit Policy: Before extending credit to customers, define your terms. This policy should outline credit limits, payment terms, and the consequences of late payments.

- Invoice Promptly and Accurately: Send invoices as soon as the work is completed or the product is delivered. Ensure they are accurate and easy to understand to avoid payment delays.

- Offer Multiple Payment Options: Make it easy for customers to pay you by accepting various payment methods, such as credit cards, bank transfers, and online payment gateways.

- Be Proactive with Collections: Don’t wait until an invoice is long overdue. Send reminders as the due date approaches and follow up consistently on late payments.

- Analyze AR Aging Reports: Regularly review your AR aging report, which categorizes outstanding invoices by how long they’ve been due. This helps you identify potential collection problems early on.

Key Differences Between AP and AR

While both AP and AR are critical to a company’s financial operations, they represent opposite sides of the cash flow coin.

| Aspect | Accounts Payable (AP) | Accounts Receivable (AR) |

| Definition | Money your business owes to suppliers. | Money customers owe to your business. |

| Balance Sheet | Recorded as a current liability. | Recorded as a current asset. |

| Cash Flow | Represents a cash outflow. | Represents a potential cash inflow. |

| Goal | To pay debts on time without disrupting cash flow. | To collect debts quickly to improve cash flow. |

| Stakeholders | Suppliers, vendors, creditors. | Customers, clients. |

The Role of Technology and Automation

Modern accounting software has revolutionized how businesses manage accounts payable and receivable. Automation tools can handle many of the repetitive, manual tasks involved in both processes, freeing up your team to focus on more strategic activities.

For AP, software can automate invoice data entry, three-way matching, and payment approvals. For AR, it can automate invoice creation, send payment reminders, and provide dashboards for tracking key metrics. Using technology can lead to faster processing times, fewer errors, and better visibility into your company’s financial status. For businesses that prefer a hands-off approach, outsourcing to professional bookkeeping services similar to those offered in Utah can provide expert management of both AP and AR functions.

Conclusion

Accounts payable (AP) and accounts receivable (AR) are essential for managing a business’s cash flow and financial stability. A disciplined approach to handling both ensures strong business relationships and long-term growth. Leveraging best practices and technology can help optimize AP and AR processes for a solid financial foundation.