The concept of generational wealth often feels elusive. It is not just about having money in the bank today. It is about creating a financial foundation that supports children, grandchildren, and future descendants. While accumulating assets is the first step, preserving them requires a completely different skillset. Families that succeed in this endeavor do so through deliberate planning, open communication, and strategic education.

Building a legacy is a marathon, not a sprint. It requires discipline and a willingness to look beyond immediate gratification. This guide outlines practical steps families can take to ensure their wealth endures and grows over time.

Establishing a Clear Financial Vision

Wealth preservation begins with a shared purpose. Without a clear vision, money can easily become a source of conflict rather than stability. Families should gather to discuss what their wealth means to them. Is it for education? Philanthropy? Entrepreneurial ventures? Defining these values early helps guide future decisions.

Creating a family mission statement is a powerful exercise. This document serves as a constitution for the family’s financial future. It outlines the principles that will govern how money is used, invested, and distributed. When everyone understands the “why” behind the wealth, they are more likely to act as responsible stewards of it.

The Importance of Financial Literacy

One of the biggest threats to generational wealth is a lack of knowledge. Money is often lost when it passes to heirs who are unprepared to manage it. Financial education must start early. Children should learn the basics of saving, budgeting, and investing long before they inherit any assets.

This education should evolve as family members grow. Young children can learn about earning and saving through allowances. Teenagers can be introduced to the concepts of compound interest and stock markets. Adults should be involved in investment meetings and estate planning discussions. By empowering the next generation with knowledge, you equip them to grow the family fortune rather than deplete it.

Diversifying Assets for Long-Term Growth

Putting all your eggs in one basket is a risky strategy for wealth preservation. Successful families diversify their portfolios across various asset classes. This might include stocks, bonds, real estate, and private businesses. Diversification helps mitigate risk. If one sector underperforms, others may compensate for the loss.

Real estate is often a cornerstone of generational wealth. Properties can appreciate over time while generating consistent rental income. Stocks and bonds provide liquidity and growth potential. Some families also invest in private equity or start their own businesses. A balanced approach ensures that the family’s financial health remains robust regardless of market conditions.

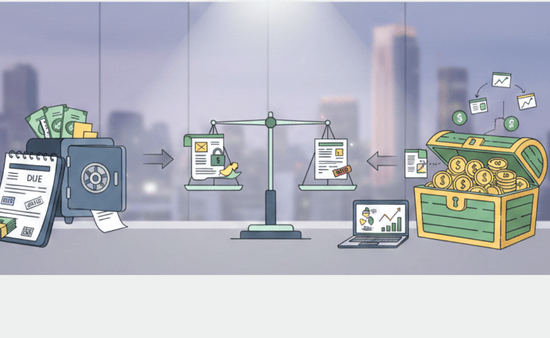

Strategic Estate Planning

Estate planning is the technical framework that holds the legacy together. A simple will is rarely enough for complex assets. Trusts are essential tools for managing how and when wealth is transferred. They can protect assets from creditors, minimize taxes, and ensure that funds are used according to the family’s values.

Regularly reviewing estate plans is critical. Tax laws change, and family dynamics shift. An outdated plan can lead to unnecessary legal battles or tax burdens. Working with legal and financial professionals ensures that the structure of the estate remains sound and effective.

Governance and Professional Guidance

As wealth grows, managing it becomes a full-time job. Families often need structured governance systems to make decisions efficiently. This might involve creating a family council that meets regularly to review financial performance and address any internal conflicts.

For families with significant assets, professional management becomes necessary. This is where family office services can provide comprehensive support, handling everything from investment management to tax strategy and philanthropic giving. These professionals act as an extension of the family, ensuring that the day-to-day details align with the long-term vision.

Fostering Open Communication

Silence is the enemy of wealth preservation. Many families avoid talking about money because it feels uncomfortable or taboo. However, secrecy breeds mistrust and unprepared heirs. Transparency is vital.

Regular family meetings provide a platform to discuss financial health, upcoming changes, and individual responsibilities. These gatherings should be safe spaces where members can ask questions and voice concerns. Open dialogue builds trust and ensures that everyone is on the same page. It transforms wealth from a taboo subject into a collaborative family project.

Conclusion

Creating generational wealth is about more than just numbers. It is about instilling values, educating the next generation, and building a structure that supports long-term success. By establishing a clear vision, prioritizing financial literacy, and seeking professional guidance, families can build a legacy that stands the test of time. The goal is not just to leave money behind, but to leave a foundation upon which future generations can build.