Metal sourcing is crucial for manufacturers, construction firms, and fabricators, as it directly impacts project quality, cost, and timelines.

Effectively navigating the global metal market means managing volatility, understanding metallurgy, and maintaining strong vendor relationships.

Since supply chain disruptions can halt production and decrease profits, businesses need a strategic procurement approach.

Understanding Metal Types and Applications

The first step in effective procurement is a deep understanding of the materials required. While engineers usually specify the grade, procurement professionals must understand the market dynamics for each type to buy effectively.

Ferrous Metals

These contain iron and are known for their tensile strength and durability. They are the most commonly sourced metals in industrial sectors.

- Carbon Steel: Used heavily in construction and pipelines. It is generally cost-effective but prone to rust if untreated.

- Stainless Steel: Valued for corrosion resistance. It is essential in food processing, medical devices, and architectural cladding.

- Cast Iron: Known for its brittleness and hardness, often used in engine blocks and cookware.

Non-Ferrous Metals

These do not contain iron, making them lighter and more resistant to corrosion.

- Aluminum: Lightweight and conductive. It is a staple in aerospace, transportation, and window frames.

- Copper: The standard for electrical wiring and plumbing due to its superior conductivity and malleability.

- Brass and Bronze: Alloys of copper used for decoration, musical instruments, and low-friction applications like bearings.

Understanding the specific application helps in finding alternative grades or sizes if the primary specification is unavailable, a crucial skill during supply shortages.

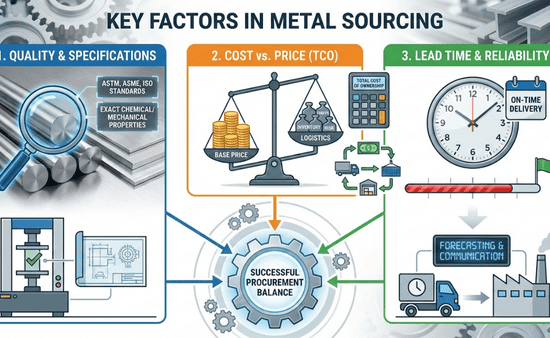

Key Factors in Metal Sourcing

Successful procurement balances three critical pillars: quality, cost, and lead time. Focusing too heavily on one often negatively impacts the others.

Quality and Specifications

In metal sourcing, “quality” isn’t just about how good the material looks. It refers to adherence to specific standards (ASTM, ASME, ISO).

If a supplier delivers steel that doesn’t meet the required yield strength, the cost savings become irrelevant compared to the liability and rework costs.

Always verify that the material meets the exact chemical and mechanical properties required by your engineering team.

Cost vs. Price

Novice buyers look at the price per pound. Strategic buyers look at the Total Cost of Ownership (TCO). TCO includes:

- Base material price: The market rate for the metal.

- Logistics: Freight costs, which can be significant for heavy materials.

- Tariffs and Duties: International sourcing often incurs extra taxes.

- Inventory Costs: The cost of storing material if you buy in bulk to get a discount.

Lead Time and Reliability

A cheap supplier who delivers three weeks late can cost you more in lost production time than an expensive supplier who delivers tomorrow.

You must align lead times with your production schedule. This requires accurate forecasting and open communication with your suppliers about their current capacity and stock levels.

How to Find and Vet Reliable Metal Suppliers

Finding a vendor is easy; finding a partner is difficult. You need suppliers who act as an extension of your business, offering transparency when markets get tough.

Start by diversifying your search. Relying on a single source is a major risk. If that mill shuts down or that distributor runs out of stock, your operations stop. Aim to have a mix of mill-direct relationships for high-volume items and service centers for smaller, quick-turn needs.

When vetting potential partners, look for financial stability and operational capacity. Ask for references and check their certifications. Geography also plays a massive role in logistics. Whether you are looking for international partners or local metal suppliers in Utah, the vetting process remains the same. You need to ensure they have the inventory on the floor and the trucks to get it to you.

Key questions to ask potential suppliers include:

- What is your on-time delivery rate?

- Do you offer stocking programs or consignment inventory?

- How do you handle material rejections and claims?

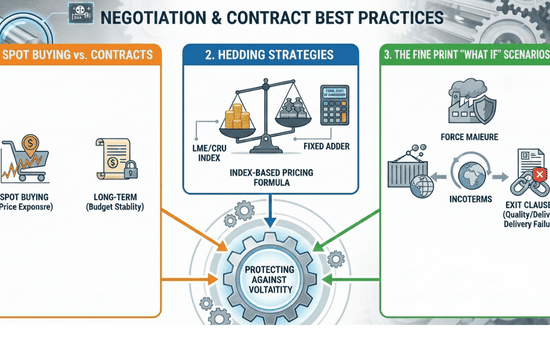

Negotiation and Contract Best Practices

Metal prices fluctuate based on global supply and demand, currency exchange rates, and geopolitical events. Negotiating a solid contract helps insulate your business from this volatility.

Spot Buying vs. Contracts

Spot buying involves paying the current market price for immediate delivery. This offers flexibility but exposes you to price spikes. Long-term agreements (LTAs) lock in pricing or a pricing formula for a set period, providing budget stability.

Hedging Strategies

For large-volume purchases, consider mechanisms to handle price changes. You might agree to a price based on an index (like the LME or CRU) plus a fixed adder. This ensures you pay a fair market rate without the supplier padding the price to cover their risk.

The Fine Print

Ensure your contracts cover “what if” scenarios.

- Force Majeure: What happens if a natural disaster hits the mill?

- Incoterms: Be clear on who pays for shipping and when the transfer of ownership occurs.

- Exit Clauses: Make sure you can leave the contract if the supplier repeatedly fails to meet quality or delivery standards.

Quality Control and Assurance

Trust is good, but verification is better. In the metals industry, paperwork is just as important as the product Longevity.

Material Test Reports (MTRs)

Never accept a shipment of critical metal without an MTR (also known as a Mill Test Certificate). This document proves the chemical composition and mechanical properties of the specific heat lot you received. It traces the metal back to the mill where it was melted.

Receiving Inspections

Implement a strict receiving process. When the truck arrives, inspect the material for visual damage, rust, or dimensional errors before offloading. Check the tags against the MTRs to ensure traceability.

Supplier Audits

For your most critical suppliers, conduct periodic audits. Visit their facility to see their quality management system in action. Are materials stored correctly? Are their measuring instruments calibrated? An audit often reveals risks that aren’t visible on a spreadsheet.

Conclusion

Metal sourcing is a complex function that sits at the intersection of finance, operations, and engineering. It requires a proactive approach to manage the inherent risks of a commodity market.